IncoDocs raises $1.2M seed round led by Maersk GrowthRead the announcement

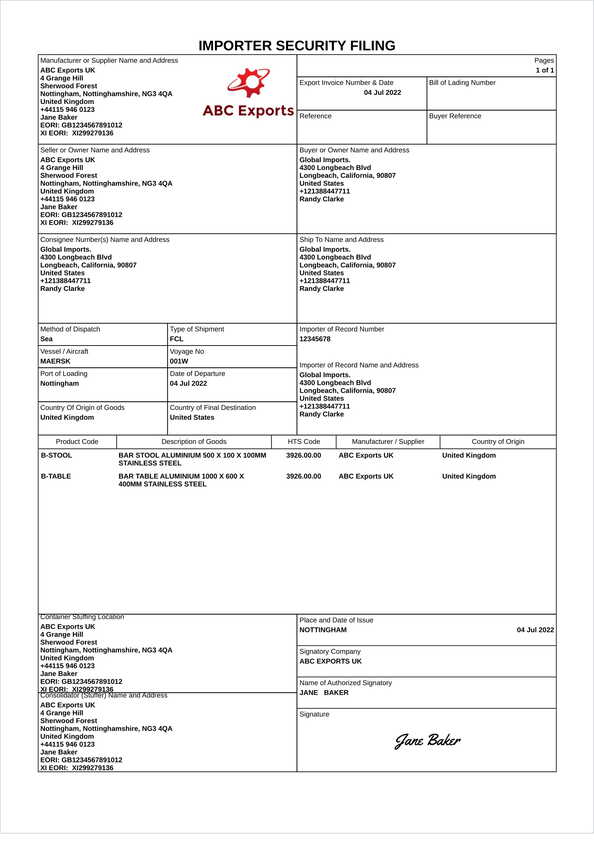

Importer Security Filing ISF Template

What is a Importer Security Filing ISF used for?

An Importer Security Filing is a filing process that is required by the United States Customs and Border Protection (CPB) which requires imported containerized cargo information. The ISF is also known as a “10+2” as it requires importers to provide 10 data elements to CBP and 2 other documents from the carrier of goods (shipping line). The information must be transmitted to the agency at least 24 hours before goods are loaded onboard a vessel to the USA. If the ISF is not transmitted in time penalties of up to US$5,000 can apply. The details included on an Importer Security Filing is used by the United States Customs and Border Protection (CPB) to correctly classify and identify all details of incoming shipments to the USA.

How to create a Importer Security Filing ISF

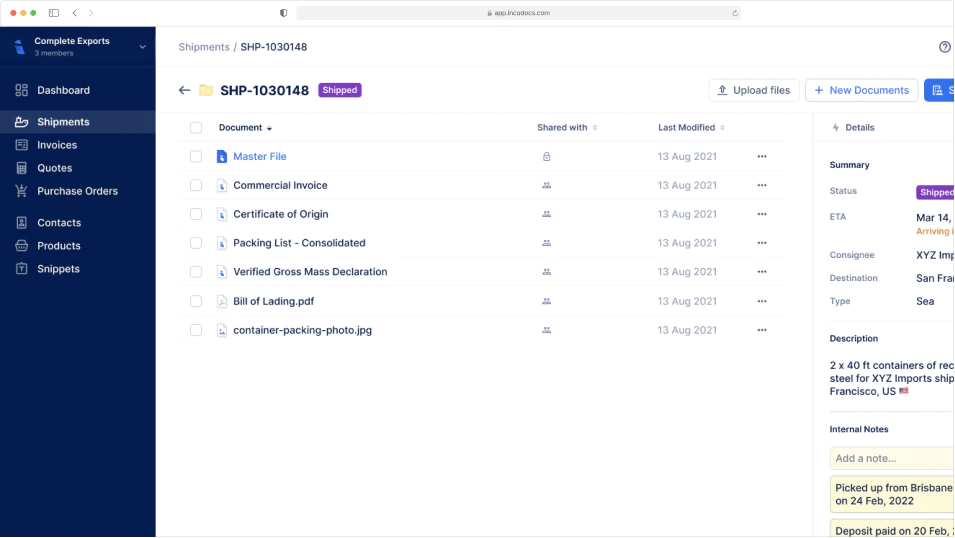

Open IncoDocs

Open IncoDocs in your browser and navigate to the “Export Docs” section.

Choose the Importer Security Filing ISF template

Click on 'New document set' and select the Importer Security Filing ISF template along with any other export documents you wish to create.

Fill out & customize your doc

Fill out the document, customize template fields to your needs and add your company letterhead. To save time and prevent re-entry errors, enter key shipment data into the Master File to have it sync across all other documents in your set automatically.

Sign & seal

Click on the signature box at the bottom of your document to create and place a digital signature then hit “Save & Quit”. On the document preview screen, click on the ‘More’ dropdown button and select “Add company seal” to place a digital stamp.

Download or share

Download or share documents from IncoDocs in 1-click. Documents can be downloaded as PDF or CSV which can be imported into other systems without manual re-entry.

Your questions, answered.

What information is included on an Importer Security Filing?

An Importer Security Filing document must contain 10 fields of information from the importer or supplier:

Can I file the ISF myself or do I need a broker?

If you're based in the U.S., you can file the ISF yourself using a secure CBP-linked platform. You’ll need an ACE account and access to a filing system. If you’re based overseas, you’ll need to appoint a licensed customs broker or a U.S. agent.

Some platforms also let foreign importers get a Customs Assigned Importer Number (CAIN) to file ISF without a U.S. Tax ID.

Where Can I Submit the ISF?

ISF filings are submitted through:

You cannot file the ISF via a public form. You must go through an authorised channel connected to CBP systems.

Where can I get a free ISF form and how should I use it?

You can sign up with IncoDocs.com and use our free ISF template to gather the 10+2 data elements required by CBP. Fill in the details before the 24-hour cutoff, then submit the form through your broker or filing system. The template helps prevent missing data.

Free to start,

Easy to use.

Setup in 5 mins.