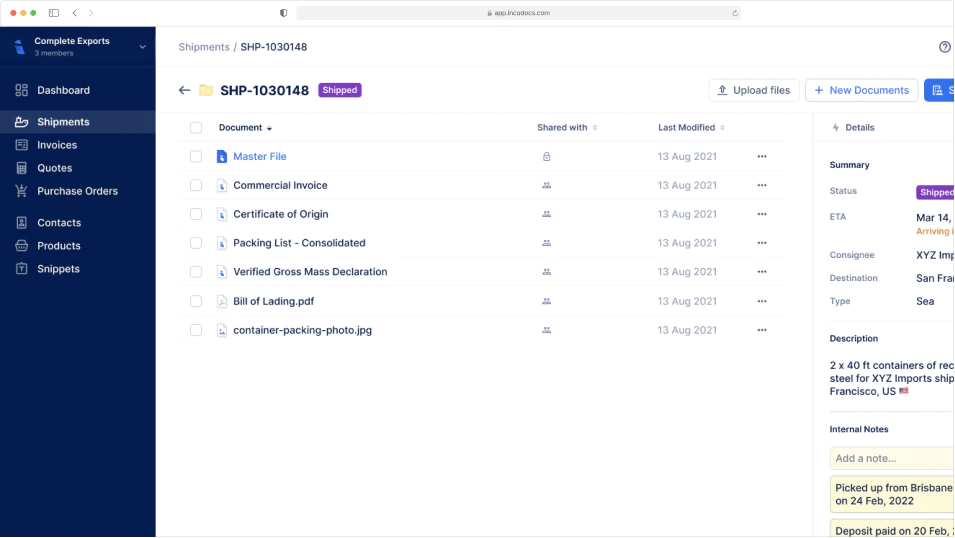

IncoDocs raises $1.2M seed round led by Maersk GrowthRead the announcement

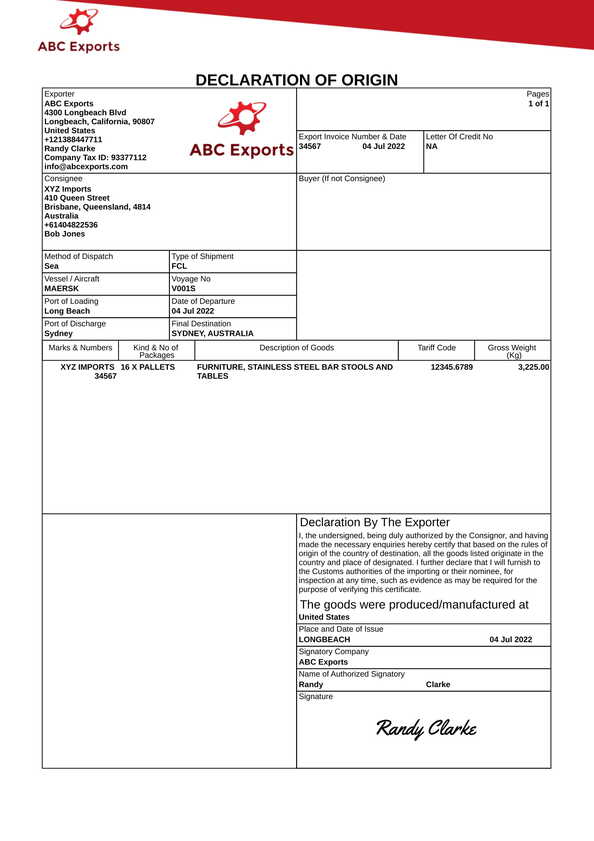

Declaration of Origin Template

What is a Declaration of Origin used for?

The Declaration of Origin document is essential for the importer's freight forwarder, customs agent, or customs broker during the import customs clearance process. Customs authorities require this document as evidence that the goods were manufactured in the country of export. This can lead to a reduction or elimination of import duties. For instance, the North American Free Trade Agreement (NAFTA) — which enhances trade amongst the U.S., Canada, and Mexico — mandates a declaration of origin to qualify for exemptions on import duties.

How to create a Declaration of Origin

Open IncoDocs

Open IncoDocs in your browser and navigate to the “Export Docs” section.

Choose the Declaration of Origin template

Click on 'New document set' and select the Declaration of Origin template along with any other export documents you wish to create.

Fill out & customize your doc

Fill out the document, customize template fields to your needs and add your company letterhead. To save time and prevent re-entry errors, enter key shipment data into the Master File to have it sync across all other documents in your set automatically.

Sign & seal

Click on the signature box at the bottom of your document to create and place a digital signature then hit “Save & Quit”. On the document preview screen, click on the ‘More’ dropdown button and select “Add company seal” to place a digital stamp.

Download or share

Download or share documents from IncoDocs in 1-click. Documents can be downloaded as PDF or CSV which can be imported into other systems without manual re-entry.

Your questions, answered.

What is the difference between a Declaration of Origin and a Certificate of Origin document?

A Declaration of Origin and a Certificate of Origin document are essentially documents that contain a statement from the shipper stating that the goods being shipped have been manufactured within the country of export. This declaration can be made on a commercial document, such as an invoice where as the certificate of origin must be on its own seperate document. Customs authorities use the information to determine the applicable customs & tariff charges which can reduce or eliminate the import duties that are payable on imported goods.

In some cases, customs departments will accept a ‘shipper’s own declaration’ which is a Declaration of Origin. A Declaration of Origin document can be created by the shipper of goods and does not require a local chamber of commerce to authorize the document and issue a certificate.

In other cases they will require a chamber to check and certify the declaration, and provide a ‘Certificate of Origin’.

What information is included on a Declaration of Origin Document?

A Declaration Of Origin or Certificate of Origin form will include the below details:

When can I use a Declaration of Origin instead of a Certificate of Origin?

You can use a Declaration of Origin when a trade agreement allows self-certification. This means the exporter can declare the origin of goods without getting a chamber or authority to approve it.

Many FTAs allow this if the exporter is registered or trusted. Some also accept it for low-value shipments. For example, under RCEP or CPTPP, approved exporters can write a declaration on a commercial invoice.

It's not always accepted. Some countries still need a Certificate of Origin issued by a chamber. Check the rules in the destination country before relying on a self-declaration.

Which trade agreements support Declaration of Origin?

Some trade agreements let exporters use a Declaration of Origin to claim tariff preferences. This is often allowed if the exporter is registered or trusted under that agreement.

Here’s a quick list of examples:

| Agreement | Countries Covered | Accepts Declaration of Origin? | Conditions |

|---|---|---|---|

| RCEP | Australia, New Zealand, China, Japan, South Korea, Indonesia, Vietnam, Thailand, Malaysia, Philippines, etc. | Yes | Must include all required origin details on invoice |

| AANZFTA | Australia, New Zealand, Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand, Vietnam | No | Requires Certificate of Origin from authorised body |

| CPTPP | Australia, New Zealand, Japan, Canada, Mexico, Chile, Peru, Malaysia, Vietnam, Singapore, Brunei | Yes | Exporter must be approved or registered |

| EU–Japan EPA | European Union (27 member states) and Japan | Yes | Must follow exact text format and reference agreement |

| USMCA (replaces NAFTA) | United States, Mexico, Canada | Yes | Declaration can be made by exporter, producer, or importer |

| ASEAN–Korea FTA | Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand, Vietnam + South Korea | No | Requires certified Certificate of Origin |

| Australia–UK FTA | Australia and the United Kingdom | Yes | Self-certification allowed by registered exporters |

Note: Rules change often. Always check with customs or a licensed broker.

Free to start,

Easy to use.

Setup in 5 mins.